Rumored Buzz on Tulsa Bankruptcy Lawyers

Wiki Article

When financial challenges pile up, and it appears like you might be sinking deeper into debt, it’s straightforward to come to feel like there is no way out. But keep on, because There's hope. Individual bankruptcy can look like a Terrifying phrase, but In point of fact, it could be a lifeline. In case you are in Tulsa and scuffling with mind-boggling personal debt, then Tulsa personal bankruptcy legal professionals are your go-to allies. They concentrate on guiding you in the murky waters of individual bankruptcy, encouraging you navigate the intricate lawful landscape to discover aid and, most significantly, a contemporary begin.

So, why really should you consider reaching out to the Tulsa bankruptcy attorney? Enable’s be genuine—working with debt could be bewildering and intimidating. The authorized jargon by yourself can make your head spin. That’s exactly where these authorized execs come in. They break down the legislation into Chunk-sized, understandable pieces, so you may make knowledgeable selections regarding your financial potential. Whether It is Chapter 7 or Chapter 13, Tulsa personal bankruptcy attorneys will wander you thru the choices, helping you comprehend which path is greatest suited to your distinctive predicament.

Tulsa Bankruptcy Lawyers Things To Know Before You Get This

There's a chance you're imagining, "Do I actually need an attorney? Can’t I just file for personal bankruptcy myself?" Sure, you could possibly make an effort to deal with it by yourself, but it’s like endeavoring to correct a broken auto with out understanding what’s underneath the hood. Personal bankruptcy regulations are advanced, and a person Erroneous go can set you back huge time. A Tulsa individual bankruptcy lawyer knows the ins and outs of such laws and may help you stay away from popular pitfalls that can derail your situation. They’re such as the mechanics in the authorized environment, fine-tuning your situation so you obtain the very best end result.

There's a chance you're imagining, "Do I actually need an attorney? Can’t I just file for personal bankruptcy myself?" Sure, you could possibly make an effort to deal with it by yourself, but it’s like endeavoring to correct a broken auto with out understanding what’s underneath the hood. Personal bankruptcy regulations are advanced, and a person Erroneous go can set you back huge time. A Tulsa individual bankruptcy lawyer knows the ins and outs of such laws and may help you stay away from popular pitfalls that can derail your situation. They’re such as the mechanics in the authorized environment, fine-tuning your situation so you obtain the very best end result.Among the list of vital roles of a Tulsa personal bankruptcy lawyer is to safeguard your property. Submitting for personal bankruptcy doesn't always mean you’ll get rid of every thing you very own. With the ideal authorized steering, you can often keep your dwelling, vehicle, and personal possessions. Tulsa personal bankruptcy legal professionals know the exemptions and protections that could be placed on your case, making sure that you just preserve just as much of your respective residence as possible while receiving rid of the personal debt that’s weighing you down.

Permit’s discuss stress. Credit card debt is usually an enormous source of tension, influencing almost everything out of your overall health to your associations. The regular phone calls from creditors, the looming danger of foreclosure, as well as the fear of wage garnishments—it’s enough to maintain you up at night. But when you seek the services of a Tulsa bankruptcy attorney, they get that stress off your shoulders. They take care of the negotiations with creditors, the paperwork, plus the court appearances. You can get to breathe slightly less difficult being aware of that an expert is in your corner, combating to your economical flexibility.

Now, you might question, "How do I pick the proper Tulsa personal bankruptcy attorney?" It’s a fair problem. Not all lawyers are designed equal. You’ll want an individual with working experience, a verified track record, and, most importantly, someone that can make you are feeling cozy. Bankruptcy is a private matter, and You'll need a law firm who listens, understands, and truly wishes to assist you. Don’t be afraid to buy close to. Fulfill having a couple of legal professionals, request thoughts, and have faith in your gut. The appropriate lawyer is likely to make all the difference.

Submitting for individual bankruptcy is a giant decision, and it’s not a person to be taken frivolously. It’s imperative that you understand that personal bankruptcy isn’t a magic wand that will immediately resolve all of your troubles. It’s additional like a reset button. Yes, it might wipe out specific debts and offer you a clean start out, but Furthermore, it includes repercussions, like a hit to your credit score score. That’s why possessing a Tulsa personal bankruptcy law firm by your side is very important. They assist you weigh the pluses and minuses, so you are aware of just what you’re stepping into before you decide to go ahead and take plunge.

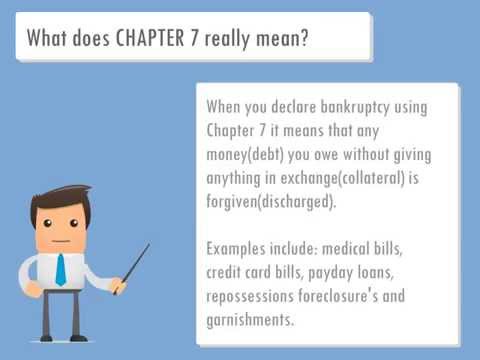

The most prevalent kinds of personal bankruptcy is Chapter seven, often called liquidation personal bankruptcy. It’s built for people who may have minor to no disposable revenue. If you qualify, a Tulsa individual bankruptcy attorney can manual you thru the entire process of liquidating your non-exempt assets to pay back your creditors. It might audio severe, but it really’s usually the quickest way to remove overpowering personal debt and start fresh. The better part? You can be credit card debt-free of charge in just some months, providing you with the financial flexibility to rebuild your daily life.

Within the flip facet, there’s Chapter 13 individual bankruptcy, which can be normally known as a reorganization individual bankruptcy. For those who have a gentle earnings but are having difficulties to maintain up along with your payments, Chapter thirteen might be a much better possibility. A Tulsa bankruptcy attorney will let you create a repayment program that actually works for yourself, permitting you to repay your debts about a duration of three to five years. The reward? You obtain to keep the assets although catching up on missed payments. It’s like hitting the pause button on your own economical tension, providing you with time for you to get back again on target.

Now, Enable’s get real to get a second. Personal bankruptcy is frequently witnessed as A final vacation resort, a closing solution when there’s no other way out. But that doesn’t suggest it’s anything to be ashamed of. Lifestyle occurs. Perhaps you misplaced your work, received hit with sudden healthcare expenses, or went through a divorce. This stuff can materialize to any one, and in some cases, individual bankruptcy is the one way to get a thoroughly clean slate. Tulsa bankruptcy legal professionals understand this. They’re not listed here to judge you; they’re here that will help you look for a way ahead.

Yet another factor to consider is the effect of personal bankruptcy with your long term. It’s legitimate that personal bankruptcy stays in your credit report for 7 to ten decades, dependant upon the form of bankruptcy you file. But below’s the silver lining—a lot of people who file for bankruptcy have already got damaged credit rating. The good news? Submitting for bankruptcy can in fact be the first step towards rebuilding your credit. With the assistance of a Tulsa personal bankruptcy law firm, you can start having measures to help your credit score score correct soon after your bankruptcy is discharged.

You may be pondering about the cost of choosing a Tulsa individual bankruptcy attorney. It’s a sound issue, specially when you’re presently managing fiscal complications. But below’s the factor—many bankruptcy legal professionals offer free consultations, they usually generally Focus on a flat charge foundation. This suggests you’ll know exactly what you’re having to pay upfront, without any hidden expenses. Think about it being an financial investment within your economical upcoming. The comfort that includes recognizing you have a skilled professional managing your situation is worthy of each penny.

Facts About Tulsa Bankruptcy Lawyers Revealed

On the subject of timing, it’s hardly ever also early to consult having a Tulsa bankruptcy lawyer. Even though you’re just beginning to fall driving with your bills, a lawyer may help you check out your choices. Individual bankruptcy might not be necessary instantly, but obtaining an attorney with your corner early on can help you prevent building pricey issues. They could advise you regarding how to handle creditors, what ways to take to protect your assets, and when it would be time to think about personal bankruptcy as a solution.When you’re concerned about the stigma of individual bankruptcy, recognize that you’re not by yourself. Lots of people truly feel humiliated or ashamed about submitting for individual bankruptcy, but it’s important to take into account that personal bankruptcy guidelines exist for your cause. They’re designed to give people today a 2nd opportunity, a method of getting again on their ft just after money hardship. Tulsa bankruptcy lawyers have noticed all of it, they usually’re in this article to inform you that there’s no disgrace in in search of enable. In reality, it’s one of the bravest find out stuff you can do.

Individual discover here bankruptcy isn’t pretty much wiping out debt—it’s about creating a improved upcoming. By removing the money stress that’s been Keeping you again, you can begin specializing in the things which truly make any difference, like Your loved ones, your job, and your wellbeing. A Tulsa individual bankruptcy law firm can help you put a strategy in place for shifting ahead, so you can start living the daily life you are entitled to. They’ll allow you to set realistic targets, rebuild your credit rating, and produce a funds that works to suit your needs.

Should you’re still around the fence about contacting a Tulsa bankruptcy law firm, take into consideration this: what do You should lose? In the really the very least, a session provides you with a better understanding of your choices and what to expect if you decide to go ahead with individual bankruptcy. Know-how is ability, and the more you are aware of, the better Geared up you’ll be to produce the correct selection on your money long run. Recall, you don’t need to experience this on your own—assistance is simply a telephone call away.

When you weigh your choices, Take into account that individual bankruptcy will not be a one-sizing-matches-all solution. What functions for just one individual may not be the only option for one more. That’s why it’s so essential to Have a very Tulsa personal bankruptcy law firm who can tailor their Tulsa Bankruptcy Lawyers guidance in your particular circumstance. They’ll take the time for getting to grasp you, understand your aims, and create a strategy that’s customized to your needs. Regardless of whether you’re experiencing foreclosure, wage garnishment, or simply just a mountain of bank card personal debt, a Tulsa individual bankruptcy lawyer may help you obtain The sunshine at the end of the tunnel.